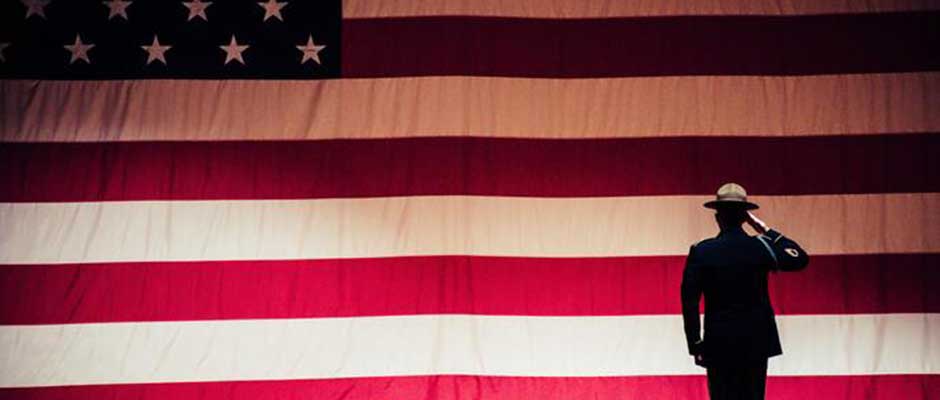

When Military Duty Calls

January 27, 2020

401(k) Plan Now Available

January 27, 2020Getting Started with WOTC, what Business Owners Need to Know

WOTC provides business owners with the opportunity for potential incentives from their recently hired employees by maximizing the work opportunity tax credit (WOTC).

Who is Eligible?

WOTC is a federal tax credit available to private-sector businesses, rewarding them for every new hire that meets eligibility requirements. The government program has identified nine target groups that have historically faced significant barriers to employment and offers participating companies between $2,400-$9,600 per new qualifying hire.

Pinnacle can help your business take advantage of these tax credits when you hire individuals from the following WOTC target groups.

| WOTC Eligibility Criteria | Maximum Tax Credit Amount |

| Food Stamp(Snap) Recipient | $2,400 |

| Unemployment Benefits Recipient | $2,400 |

| Long-Term TANF Recipients | $9,000 over 2 years |

| SSI Recipient | $2,400 |

| Empowerment Zone Recipient | $2,400 |

| Ex-Felon | $2,400 |

| Veteran | $2,400-$9,600 |

| Vocational Rehab Referral | $2,400 |

| Summer Youth | $1,500 |

Our Services Include:

- Screening for WOTC, Empowerment Zone, Disaster Relief & State Credits.

- Electronic tax credit screening that integrates with hiring process.

- Filing forms and documentation necessary for WOTC certification. Calculating and reporting tax credits quarterly.

- A turnkey solution which saves implementation time for immediate tax credit realization.

- Please take a moment to read our 401(k) Plan Now Available and When Military Duty Calls articles, these blog articles are a great source of information.

- Download this article for distribution and printing here. All our Blogs can be viewed here.