Preparing for an Unemployment Hearing

April 27, 2021

Identity Theft and the Dark Web

June 23, 2021In 1986, Congress passed the Immigration Reform and Control Act (IRCA), a law that altered U.S. immigration law, making it illegal for businesses to knowingly hire illegal immigrants and placing financial and other penalties for companies that hired illegal immigrants.

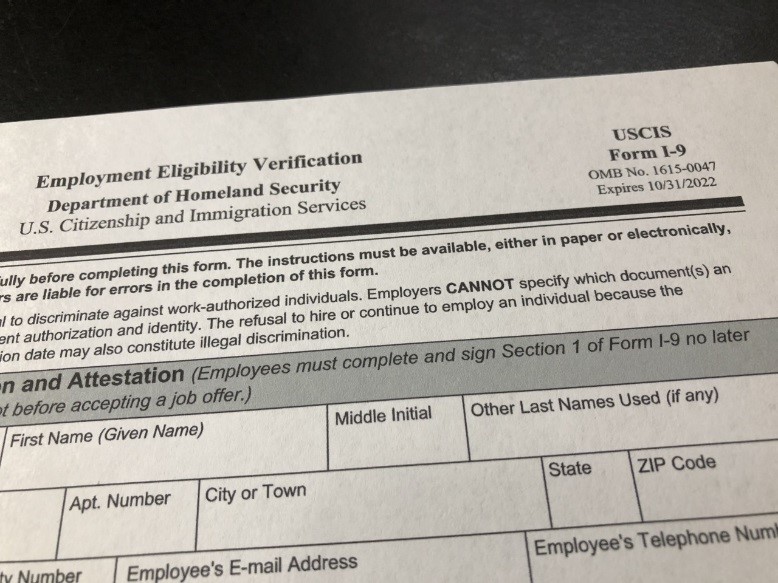

To enforce these laws, the federal government requires employers to verify a potential employee’s eligibility to work in the United States by completing the Employment and Eligibility Verification Form (Form I-9). By completing Form I-9, the employer is certifying that it has viewed documents proving that the potential employee is authorized to live and work in the United States.

Filling Out Form I-9

Completing Form I-9 requires accurate detail. Employees working less than three business days must complete Sections 1 and 2 of Form I-9 before beginning to work. If the individual is hired for work lasting longer than three days, the form must be filled out before the end of the third day of employment.

Employers can hire an outside business or contractor to verify a potential employee’s eligibility, but the employer is ultimately responsible for the contractor’s actions and the employee’s status.

Form I-9 has three sections— the first section is completed by the employee, the second is completed by the employer or an authorized representative on behalf of the employer, and the third is completed only when rehire, re-verification, or a name change of the employee.

Section 2 must be completed and signed within three business days of employment, and the employer must physically inspect one document from List A or a combination of documents from List B and C. The documents that are acceptable for each of the lists are as followed:

List A

- United States Passport

- Permanent Resident Card or Alien Registration Card, Form I-551

- Unexpired foreign passport with a temporary I-551 stamp

- Unexpired Employment Authorization Document containing a photograph: Form I-766 Employment Authorization Document

- Unexpired foreign passport with an unexpired Arrival-Departure Record, Form I-94, bearing the same name as the passport containing an endorsement of the alien’s non-immigration status (if that status authorizes the alien to work for the employer)

- Passport issued from the Federal State of Micronesia (FSM) and the Republic of the Marshall Islands (RMI) with a valid Form I-94 or I-94A

List B

- Driver’s license or identification card issued by a state or possession of the United States containing a photograph or information such as name, date of birth, gender, height, eye color, and address

- School identification card with photograph

- Voter’s registration card

- military card, draft record or military dependent’s identification card

- An Identification card issued by federal, state or local government agencies or entities containing a photograph and name, date of birth, gender, height, eye color, and address

- Coast Guard Merchant Marine Card

- Native American tribal documents

- Canadian driver’s license

- Those under 18 can present a school record, report card, clinic or doctor record, or a day-care or nursery school record

List C

- Social Security Number Card issued by the Social Security Administration

- Original or certified copy of a birth certificate issued by the state, county, municipal authority or outlying possession of the United States bearing an official seal

- Certificate of birth abroad issued by the Department of State (Form FS-545 or Form DS-1350)

- Unexpired employment authorization document issued by the Department of Homeland Security

- Form I-197 U.S. Citizen Identification Card

- Native American tribal document

- Form I-179 Identification Card for Use of a Resident Citizen in the United States

Employer Penalties for Violation of IRCA

Under IRCA, employers can be fined for not complying with Form I-9 guidelines, accepting fraudulent documents when determining employment eligibility or discriminating against individuals based on their nation of origin or citizenship status. Monetary penalties that can occur for violating IRCA can be quite large, with repeat offenders receiving penalties on the higher range of the scale.

It’s important to properly verify every employee’s citizenship status when hired to avoid such costly fines. It is also important to conduct internal audits regularly to ensure your business is complying with the law. You may also want to consider consulting an attorney to review your procedures and forms to be as prepared as possible in the event of an audit.

- Please take a moment to read this month’s Identity Theft and the Dark Web and Compliance with Federal Form I-9 articles, these blog articles are a great source of information.

- Download this article for distribution and printing here. All our Blogs can be viewed here.